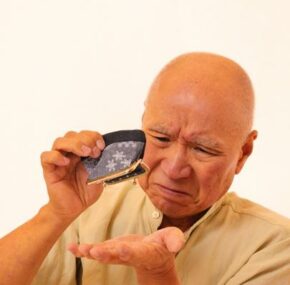

Elderly Americans lose $36.5 billion annually as victims of financial exploitation, and one out 18 senior adults fall victim to this form of elder abuse. This is a threat to the financial security of all seniors, especially those that suffer from cognitive or physical issues. Awareness of this issue is increasing. The number of frauds committed continues to grow. In almost 97 percent of cases, these financial frauds go undetected until serious financial problems appear.

Who Commits Elder Financial Exploitation?

Almost anyone who has access to an elderly person can commit abuse through financial exploitation. According to the National Center on Elder Abuse, 90 percent of financial abuse is committed by people close to the victim, including family members, caregivers, neighbors or friends. Strangers can also commit acts of financial exploitation on unsuspecting and often, trusting seniors; including scam artists, salespeople, and contractors.

Risk Factors for Becoming a Victim

Age is the biggest risk factor for becoming a victim of financial exploitation. Financial regulators have gone as far as to label seniors over 70 years of age as the “Silent Generation.” This is the age group most vulnerable to financial fraud. A survey by the North American Securities Administrators Association found that 45 percent of financial crimes committed involved seniors in the 81-90 year-old range.

The risk of becoming a victim increases if the elderly person:

- Suffers physical disabilities

- Is isolated from others, like living in a nursing home

- Is cognitively impaired

- Cannot manage his or her finances after a spouse dies

Ways that Assets Could Be Misused

There are different methods in which an elderly person’s assets could be abused. They might have no knowledge that the abuser is taking his or her personal property, cash or other assets. Or the victim could be threatened, intimidated or coerced into giving assets to the abuser. The abuser might gain access to a victim’s assets by securing a power of attorney.

In many cases, by the time the financial crime is uncovered, the money is long gone. Any hope for recovery often involves help from an elder abuse attorney. Becoming aware of risk factors and knowing who has access to elderly loved ones could help protect them from financial exploitation.